Commercial and Mixed-Use Commercial Projects in NSW

Advisory

Site Area: 5,336m2

Category: Retail, supermarket, health club, veterinary and GP clinic and office.

Investor: Private Investor

Mixed Commercial Office, Wollongong NSW

Palladium Property was appointed to prepare a preliminary review of local supply and demand factors to identify in the early concept stages the potential demand best uses for the non-residential component of the development located in Wollongong, NSW. Palladium assessed the current and forecasted supply and demand for permitted uses. The analysis helped in identifying potential for a purpose-built childcare centre for 60 to 90 places, retail operator for a fruit and veg grocer, medical consulting centre, 24-hour veterinary and GP clinics, 24-hour gym and health club and office space. The strata size and large floor plates are 50 to 200m2 commercial business premises exposed to the street, café and restaurant and a small bar.

Property Portfolio Assessment

Category: Owner-occupied mining services.

Investor: Large Corporate

Commercial Owner-Occupied Properties

Palladium was appointed to conduct a comprehensive preliminary assessment of six large property assets owner-occupied by a large mining services organisation. Comprised investigation of the use of the property and buildings associated risks, facilities and property management processes, and corporate government policies and practices relating to property use. Comprehensive report to the senior executive and board to identify areas of further investigations and recommended actions. Through the contracting of external legal expertise in corporate governance and expertise in facilities management procedures, Palladium was able to provide a comprehensive analysis and tangible recommendations at competitive fees.

Development Project Management

Site Area: 6,500 m2

Category: Retail, office, childcare, medical and mixed-use.

Investor: Private Family Investment Trust

Multi-Use Proposed Development, Hills Shire LGA NSW

Pursuant to an assessment of the development potential of the rezoned development site within the new Local Environment Plan, Palladium is appointed as Development Managers to progress the site’s development potential to service the wider community and provide local employment. This includes coordination of a full range of select professional consultants and ongoing liaison with various authorities to secure timely approval for this high calibre local centre based on sustainable design principles by the Council and the Joint Regional Planning Panel.

Advisory and Facilitation

Category: Investment attraction specialist.

Investor: Department of Premier and Cabinet (NSW Government)

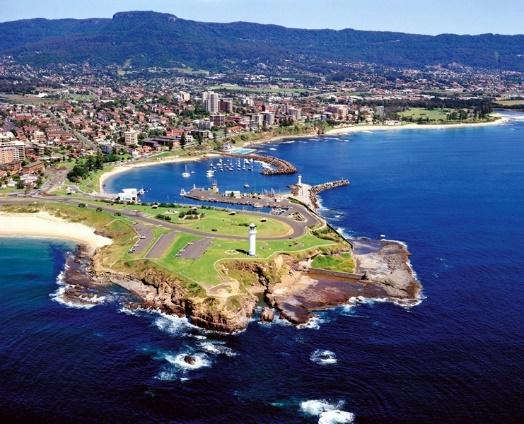

Wollongong City Centre Project

Palladium was appointed to review investment potential for both corporate Australia and property developers and investors, design and implement an engagement and advocacy campaign and facilitate new relations from the property and corporate companies with key stakeholders.

We devised an engagement strategy for both business space users and property investors and developers and identified the key industry sector benefits. The process comprises the implementation of the engagement process through targeted approaches with correspondence, verbal and meetings to motivate interest, generate engagement with key stakeholders and invest in the continuing growth phase of the Wollongong CBD.

Advisory, Development Project Management & Transaction Management

Category: Commercial childcare, value $26 million.

Investor: Private Developer

Proposed Commercial Office & Mixed Uses in Wollongong NSW

Palladium was appointed to provide our full suite of professional services from project inception, including analysis of demographic factors, a review of retail trade areas and drive times, investigation into local dynamics, analysis of rental evidence and assessment of indicative rents likely to be achieved within the proposed development.

Key roles were to:

- Identify and secure corporate offices/government users before completion

- Manage EOI campaign and secure leading child care operator on a long term lease

- Assist with funding application supporting documents and seek Joint Venture Equity Partner

- Manage effective branding & marketing process to secure pre-commitment

- Appoint and manage leading ESD consultant to ensure target Green Star and NABERS design and as-built solution

- Co-ordinate the professional consultants (architects, planning, engineering, traffic consultants, ESD to ensure maximum efficiency of net lettable areas and reduced construction costs

- Devise and manage the branding/marketing process

Transaction Management

GFA: 9,500m²

Category: Commercial.

Investor: Private Developer

Proposed Commercial Office, Gym & Childcare in Five Dock, NSW

Palladium devised a marketing strategy, “Work, Learn & Play”, and managed the leasing process through select agents to secure pre-commitment from anchor tenants, building the brand profile before completing the project. This was achieved through pre-lease analysis, anchor tenant identification and negotiation, project branding and leasing management. Success included securing ABC Learning Centres on a long term lease and assisting with a long-term lease to Fitness First.

Advisory and Transaction Management

GLA: 632m²

Category: Commercial.

Investor: Deceased Estate

Existing Service Station Site, Balmain NSW

Palladium provided strategic advice regarding disposal strategies to maximise the return and minimise the discounting due to potential site contamination. Independent initial reviews were undertaken to identify disposal potential on the open market. Associated risks due to possible contamination of the site and likely remediation requirements were assessed and recommendations made. The disposal of the property on favourable terms was managed by Palladium.

Commercial Office Space (director with the previous firm)

Category: Lessee advisory and representation.

Investor: Global Boutique Fund Manager, Sydney

Lessee Advisory and Representation

We advised and represented a boutique fund manager to successfully secure new office facilities in the Sydney CBD on competitive terms. The role comprised strategic advice identifying a short-list of various A-Grade office alternatives for a medium-term lease to accommodate corporate growth. Competitive rental and innovative structuring allowed for an early exit to accommodate the forecast rapid company growth, and relocation to larger premises were negotiated to provide the space user flexibility at minimum cost.

Commercial Office Space (director with the previous firm)

Category: Lessee advisory and representation.

Investor: ASX Listed Resources Company

Lessee Advisory and Representation

We advised and represented this ASX Listed resources company to identify and secure various office alternatives on the North Shore for medium-term lease to reflect the changing accommodation requirements of the department. The optimum solution achieved was the negotiation of an attractive rental, favourable and flexible terms best suited to the company’s requirements by retaining the existing office space.

Initial Property Market Research, Pre-Purchase Due Diligence and Acquisition

Category: Premium office strata investment, Sydney CBD Fringe. Multi-level new commercial strata building.

Investor: International and Australian Shareholders

Acquisition of Investment Office Suite, Pyrmont NSW

We advised and represented this ASX Listed resources company to identify and secure various office alternatives on the North Shore for medium-term lease to reflect the changing accommodation requirements of the department. The optimum solution achieved was the negotiation of an attractive rental, favourable and flexible terms best suited to the company’s requirements by retaining the existing office space.